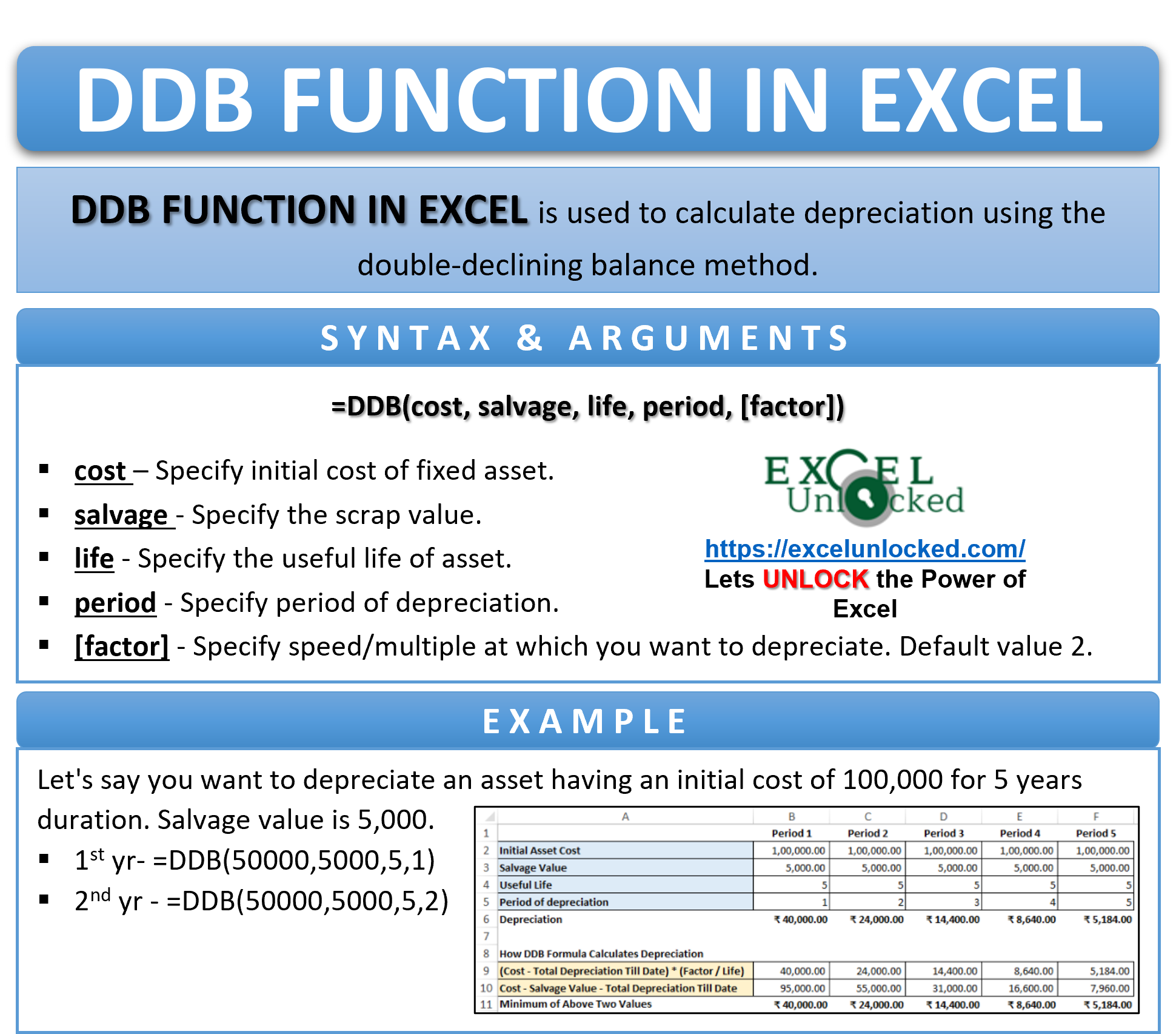

The DDB function in excel is one of the financial Excel formulas. This function is useful for calculating depreciation on fixed asset in excel. In this tutorial, we would learn how to use the DDB formula in excel to calculate depreciation on an asset.

There are two basic excel formulas that are used to compute depreciation on assets in excel – 1) DDB function and 2) DB function in excel. The major difference between these two functions is with regard to the method of computation.

- DB function calculates depreciation using fixed-declining balance method. Check our exclusive blog on excel DB function to learn more about it.

- On the other hand, the DDB function calculates depreciation using double-declining balance method.

Let us now deep dive into using DDB function of excel.

When To Use DDB Function in Excel

The expression DDB stands for ‘Double-Declining Balance’.

The DDB formula in excel is an excel depreciation formula that helps to compute depreciation on a fixed asset using the double-reducing balance method in excel. It calculates depreciation using the double-declining balance method.

The depreciation during initial years is higher than the depreciation during latter years (accelerated depreciation).

Unlike the DB excel function, the excel DDB formula is flexible in a way that you can also specify any other method by changing the factor argument.

Syntax and Arguments

=DDB(cost, salvage, life, period, [factor])

- Cost – Specify the intial capitalized cost of asset.

- Salvage – Specify the scrap value (useful life end sale value) of the asset.

- Life – In this argument, enter the useful life of the asset.

- Period – Specify the period to calculate the depreciation for. It should be of the same unit of measure as asset’s life.

- Factor – In this optional argument, specify the rate/speed at which the asset’s balance is to be declined. If the factor argument is omitted, then formula considers it as 2 (i.e. depreciation at double declining rate).

How DDB Formula Calculate Depreciation Value?

The double-declining balance method calculates the depreciation at the double rate (i.e. twice rate) than the straight-line method (SLM).

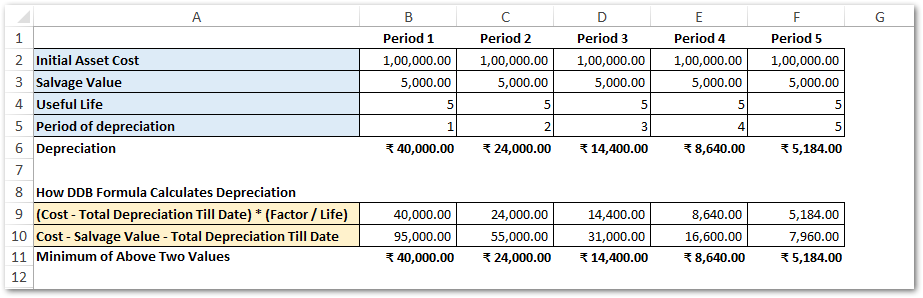

The depreciation amount is calculated as the minimum of the below two values.

- (Cost – Total Depreciation Till Date) * (Factor / Life)

- Cost – Salvage Value – Total Depreciation Till Date

Learn how to find minimum value in excel using MIN formula in excel.

Example of Using DDB Function in Excel

In this section, let us take a practical example to understand how to use the DDB formula in excel.

Let’s say that you have an item of furniture costing $100,000 having a useful life of 5 years and scrap value of 5,000. Let’s calculate depreciation for 5 years using the DDB formula in excel.

Firstly, use the below formula to calculate the depreciation using the double-declining balance method:

=DDB(100000,5000,5,1)

As a result, excel would return the depreciation value as 40,000.

It is simply the minimum of the following two values:

- (100000-0)*(2/12) = 40,000

- 100000-5000-0 = 95,000

Now, to calculate depreciation using DDB for the second year, use the following formula:

=DDB(100000,5000,5,2)

As a result, excel returns depreciation value as 24,000 calculated as minimum of these two values:

- (100000-40000)*(2/12) = 24,000

- 100000-5000-40000 = 55,000

Similarly, the calculation of years 3, 4, and 5 goes like this:

It is important to note that since we have omitted the factor argument, the declining rate is 2.

To change the declining rate, simply use the optional argument of the excel DDB formula.

=DDB(100000,5000,5,1,3)

In the above formula, the fifth and the last argument value (3) denotes the rate of decline.

#NUM! and #VALUE! Error – Excel DDB Formula

- TIf you specify a non-numeric value to DDB argument, the formula returns #VALUE! error.

- Similarly, the DDB function returns #NUM! error code on any unrealistic arguments, such as:

- Initial cost or salvage value less than zero, or

- Useful life less than equal to 0, or

- Period argument greater than the asset’s useful life.

Learn more about all the excel error codes here.

Thank You for Reading 🙂

RELATED POSTS

- AMORLINC Function of Excel – Finding the Depreciation of as Asset

- AMORDEGRC Function of Excel – Linear Depreciation of an Asset

- FV Function of Excel – Find Future Value of Investment

- Excel PV Function – Calculate Present Value PV in Excel

- Excel RATE Function – Calculating Interest Rate for Specified Period

- DATEVALUE function in Excel – Get Date Serial Number