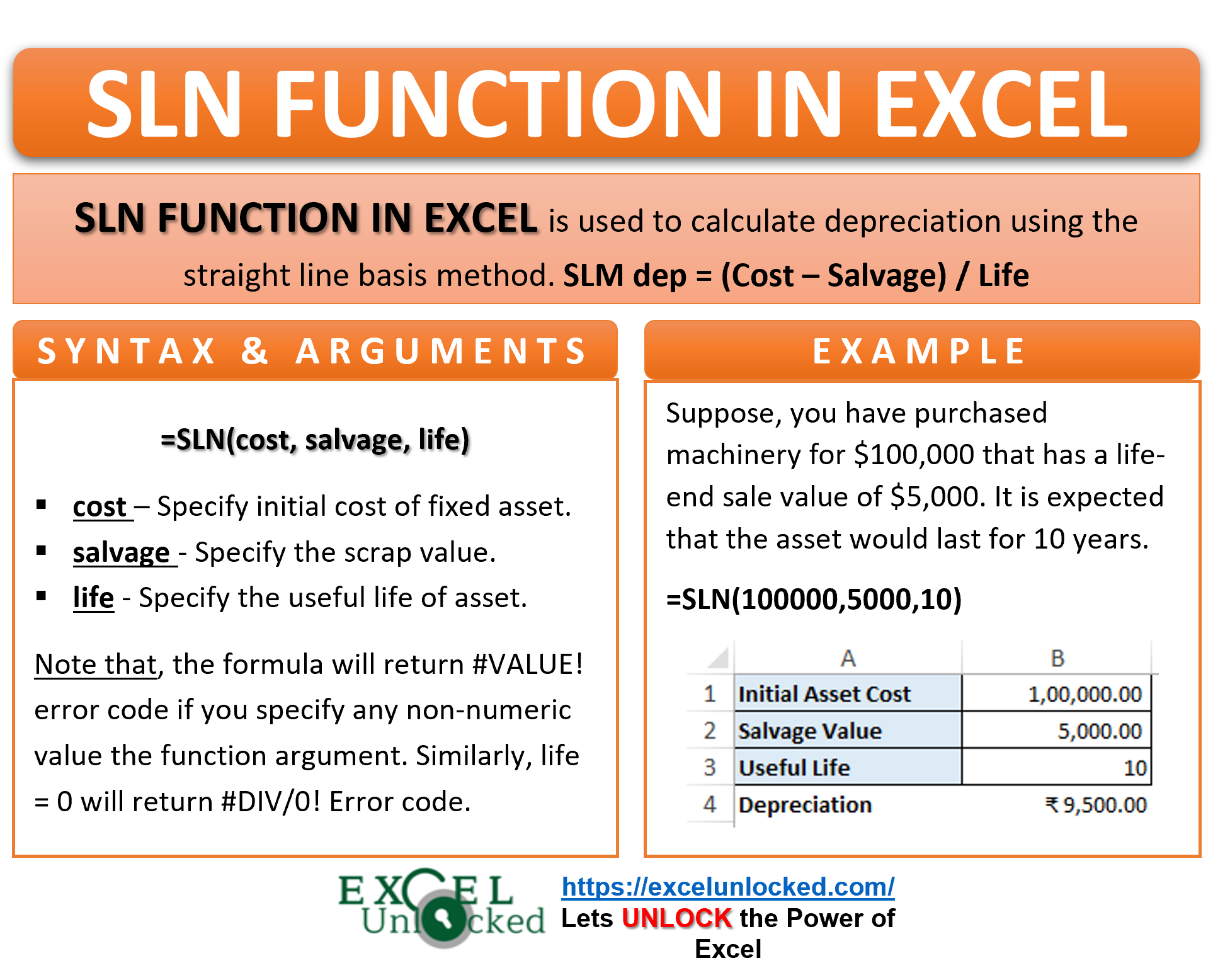

Depreciation refers to a decrease in the value of a fixed (non-current) asset due to time, wear and tear, obsolescence, etc. There are various methods to calculate depreciation, which include straight-line method (SLM), written-down value method (WDV), depletion method, etc. In this tutorial, we would learn how to calculate depreciation in excel using the straight-line method using the SLN function in excel.

This blog covers how and when to use the SLN formula in excel, its syntax, arguments, and possible errors.

Here we go 😎

When To Use Excel SLN Function

The Excel SLN formula is used to calculate depreciation in excel for a period using the straight-line method (SLM). It is an excel formula for straight line method depreciation. It belongs to the excel financial function group.

Other depreciation calculation formula in excel are – DB function and DDB function.

Syntax and Arguments

=SLN(cost, salvage, life)

The arguments of the SLN excel formula are explained in the below points:

- Cost – Here, specify the initial cost of fixed asset (gross book value).

- salvage – In this argument, mention the scrap value at the end of the useful life of the asset.

- Life – Specify useful life of the asset.

It is important to note that the cost, salvage, and life arguments of the SLN function must be a numeric value. Otherwise, the function will return an excel error.

Mathematical Expression of SLM Method?

The SLM method is one of the simplest method to calculate depreciation for any fixed asset. It follows the below mathematical formula for calculating depreciation in excel:

SLM Depreciation = (Cost - Salvage value) / Useful Life

How to Calculate SLM Depreciation? – SLN Function Excel

Let’s see how to calculate the straight-line depreciation in excel using the SLN formula.

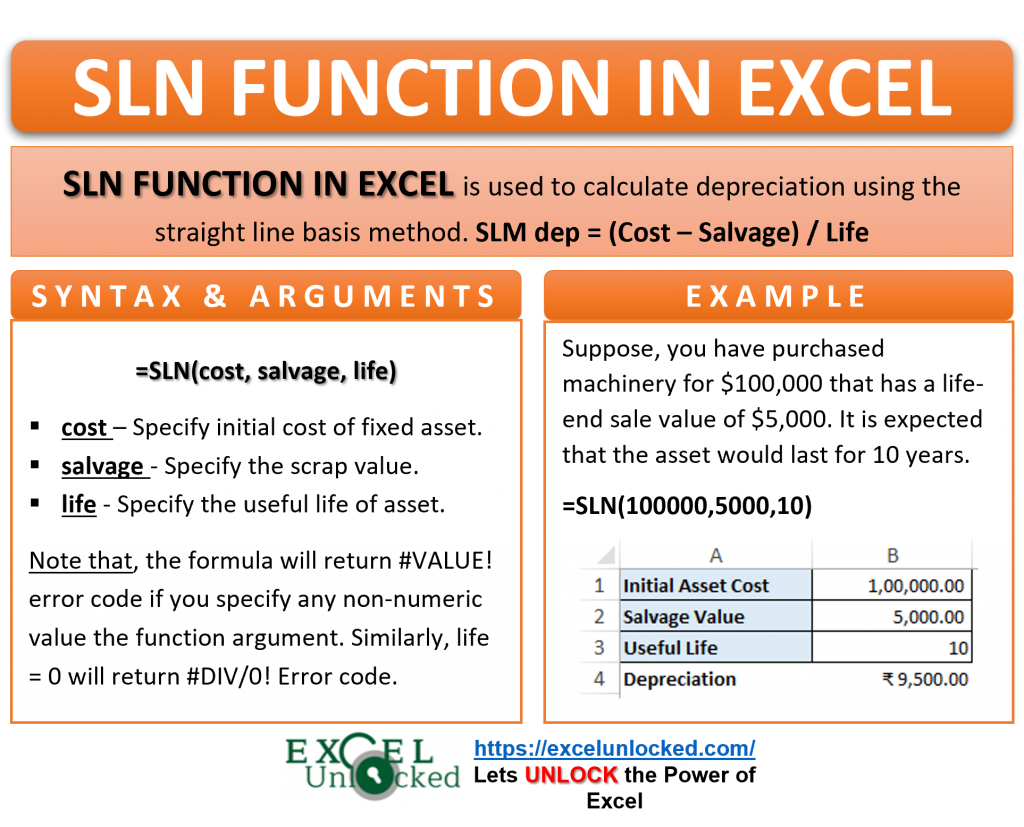

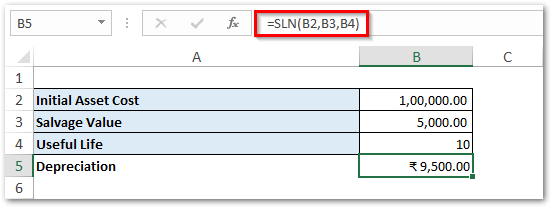

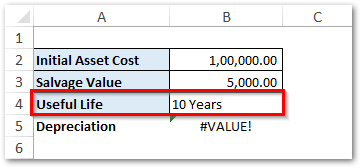

Firstly, let’s take an example of SLN formula function to calculate SLM depreciation. Suppose, you have purchased machinery for $100,000 that has a life-end sale value of $5,000. The asset would last for 10 years.

Mathematically, the depreciation calculation using SLM method goes like this:

(100,000 – 5,000)/10 = $9,500

To achieve this use the following SLN formula:

=SLN(100000,5000,10)

As a result, the formula will return the depreciation amount as 9,500.

Note that, this depreciation amount is for one period. Consequently, the depreciation amount remains the same for each of the years, as it is SLM method.

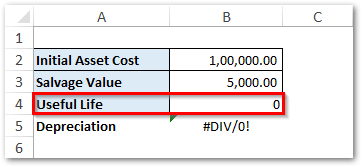

#DIV/0! and #VALUE! Error in SLN Function

- The SLN formula returns #DIV/0! error code, when useful life argument is equal to zero (0).

- Similarly, the formula returns #VALUE! error code on non-numeric arguments.

Thank you for reading 🙂

RELATED POSTS

- Excel DDB Function – Compute Depreciation Using Formula

- AMORDEGRC Function of Excel – Linear Depreciation of an Asset

- Excel PV Function – Calculate Present Value PV in Excel

- FV Function of Excel – Find Future Value of Investment

- NPV Function – How to Calculate NPV in Excel

- DATEVALUE function in Excel – Get Date Serial Number